Page 1 of 3

Overseas purchases and imports

Posted: Sat Jan 02, 2021 8:59 pm

by whitestone

Well things just got frustrating! The government now require any company selling goods into the UK to be registered and collect VAT for them

https://www.gov.uk/government/publicati ... nuary-2021

I tried a couple of test "purchases" of €80 & €200 from Extremtextil in Germany and with both I got this:

The selected country is not available for shipping. Please select another shipping address

No idea who is registered and who isn't, seems like test purchases are the only way. Might be a while before it sorts itself out and companies register or find some way of doing business here.

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:02 pm

by Bearlegged

Brooks have currently suspended UK sales of their UK-made saddles, as all distribution goes through their logistics centre in Italy.

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:09 pm

by FLV

Yes, annoying isnt it. I noticed folk like bike24 aren't shipping either.

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:12 pm

by ton

Vaude and Rose are not taking orders for the UK.

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:13 pm

by johnnystorm

I doubt test purchases will be necessary, they'll just flag up a "no ta" message when you try and put UK as a delivery address or not as the case may be. I expect it'll get sorted out eventually but with fewer options as small firms find it isn't worth the hassle or the price with taxes means we don't bother.

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:23 pm

by Cheeky Monkey

Unsurprising it's cr8p at the mo'. Early days but I imagine it'll settle. Yet another great wonderful aspect of Brexit

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:23 pm

by whitestone

Oh, I wasn't actually making a purchase, just getting to the delivery address part.

As far as I got, Enlightened Equipment in the States are shipping to the UK as are Cumulus in Poland.

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:46 pm

by Mike

Take up running that way we don't have to pay for over priced bike parts and all the maintenance costs, just need a pair of trail shoes and ya good

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:54 pm

by paramart

Mike wrote: ↑Sat Jan 02, 2021 9:46 pm

Take up running that way we don't have to pay for over priced bike parts and all the maintenance costs, just need a pair of trail shoes and ya good

spent more on running equipment than bike stuff this year, and doesn't last as long,

Re: Overseas purchases and imports

Posted: Sat Jan 02, 2021 9:56 pm

by sean_iow

Yeah, my running shoes only seem to last 200 miles

and full price they're well over £100, which is why I'm always in last season's styles bought in the sales.

Re: Overseas purchases and imports

Posted: Sun Jan 03, 2021 12:17 am

by AlasdairMc

sean_iow wrote: ↑Sat Jan 02, 2021 9:56 pm last season's styles bought in the sales.

That’s one plus about bike gear. I haven’t a clue what season my stuff is from, other than distinguishing between summer and not summer.

Re: Overseas purchases and imports

Posted: Sun Jan 03, 2021 10:01 am

by sean_iow

I only know they are last season's as they are in the sale. Unfortunately as a size 45 (am I a 10 now we've left) I'm a common size and as everyone has decided to take up running during lock-down I'm struggling to find any to replace my current pair.

I had a package from the USA last week, it had a Border Force sticker on it. The item was only £27 but I ended up paying £6.31 Vat plus £8 handling fee.

I bought it from a UK shop, paid in £s and there was no indication that they would ship it from abroad so I'll be emailing them to get the customs fees back from them.

Re: Overseas purchases and imports

Posted: Sun Jan 03, 2021 1:58 pm

by Bearbonesnorm

I did read yesterday that everything now coming in from China will be subject to customs charges - Aliexpress won't seem so cheap now I guess.

Re: Overseas purchases and imports

Posted: Sun Jan 03, 2021 4:49 pm

by Mart

I recon the UK market will be too large for companies to continue not to supply. something will need to be sorted re the tax issue but I’m not expecting much change until it does. That could take some time

Re: Overseas purchases and imports

Posted: Sun Jan 03, 2021 6:22 pm

by Lazarus

That will rather depend on how muc they sellto us

i am sure Rose and others willsort it less sure Cummulus will or Extremil [ spelling]

re china the new rules are

The seller must charge and account for VAT at the point of sale, unless the consignment is a business to business sale and the customer has given them their UK VAT registration number.

the company itself needs to do this if under £135 and charge the VAT [ and therefore register in the UK] and send it to HMRC

I suspect a lot of small sellers wont be bothered but the larger ones will [ eventually] probably

If its over £135 they can just pass it all to you so you willpay VAT and the additional Post OFiice charge as well,

https://www.gov.uk/guidance/vat-and-ove ... nt-of-sale

However the iink it gives you on that page [ovee $135] tells you its out of date despite it being the new advice.

Amaigly this givt has given confusing, disjointed and chaotic advice...its so unlike them.

Re: Overseas purchases and imports

Posted: Sun Jan 03, 2021 8:31 pm

by frogatthefarriers

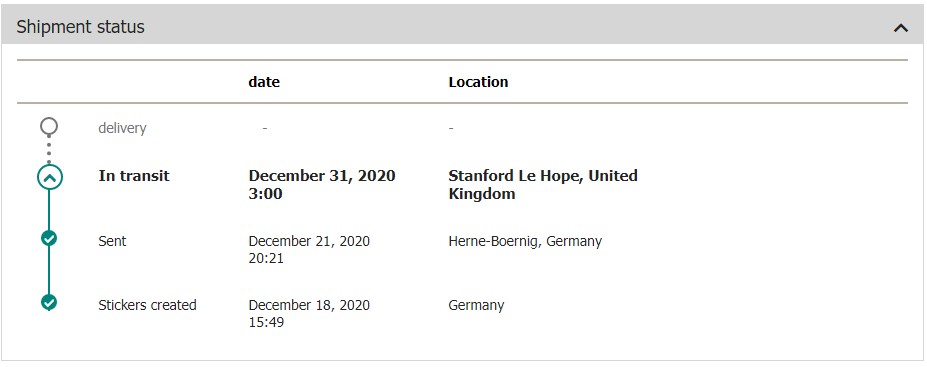

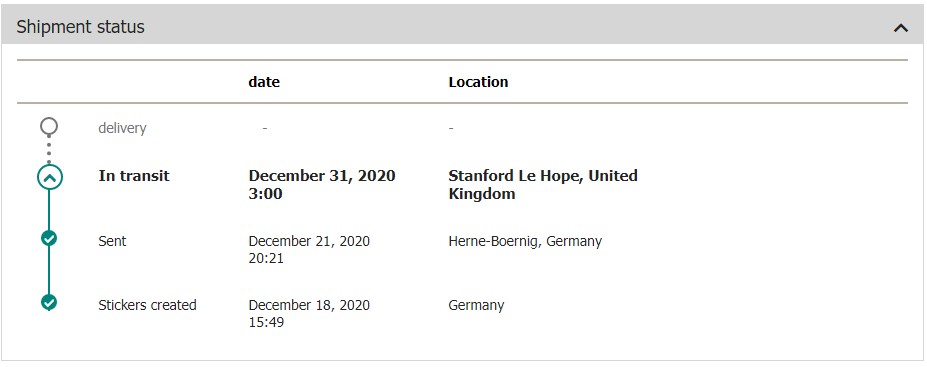

I bought and paid for a watch from Germany on 16th December - just before the shenanigans in Dover. They took my money and said it was dispatched and gave a delivery date. Immediately afterwards I got mail in German saying delivery was delayed. No date. Now you’ve got me worried with talk of import duty. My feeling is that since I’d already paid for it before Brexit, I’ll have paid the existing VAT so shouldn’t have to pay it again. Please tell me it’s so! Please!

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 3:55 pm

by Asposium

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 4:03 pm

by Lazarus

@ frog I bought something from China in decemebr [ not due till March - what can i say it was dirt cheap] so also interested to see if they use th epurchase date or th eimport date

That BBC article makes a good point just use the PO for the VAT and charges - would be chaos if every single country made companies do this - though personally I expect a lot of presents from my EU based friends

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 4:05 pm

by Cheeky Monkey

I'm a touch perplexed that UK / HMRC expect overseas businesses to collect VAT and then pay it to the UK. Surely such businesses are not governed by UK law (sure sales into UK customers are but the companies themselves are located outside it). So how is UK Govt / HMRC going to enforce it? International court cases for VAT on cumulative sales of orders <£135. Seems unlikely

Happy to be schooled or have any basic misunderstandings corrected

Be a dick and be prepared to do one

Edit: and oh so pleased I got my Cumulus quilt before this all kicked in / off / over

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 4:18 pm

by sean_iow

Cheeky Monkey wrote: ↑Mon Jan 04, 2021 4:05 pm

Edit: and oh so pleased I got my Cumulus quilt before this all kicked in / off / over

I wish I'd bought my jacket last year

It may be that my cousin in Ireland is getting a jacket delivered, re-wrapping it in birthday paper and sending it to me for my Birthday*

* Which is in February so not that far fetched.

Edit, A quick look on the Gov website seems to indicate that it would be over the acceptable value for a gift.... he'll have to say in the card he bought it at the market

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 7:09 pm

by ScotRoutes

I had ordered some spokes from Rose Bikes just before Christmas. Looks like I might have

just escaped any hassles!

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 7:25 pm

by Lazarus

it would be over the acceptable value for a gift.

Dear Sean

Thanks for lending me your jacket here it is returned to you

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 7:29 pm

by stevenshand

Cheeky Monkey wrote: ↑Mon Jan 04, 2021 4:05 pm

I'm a touch perplexed that UK / HMRC expect overseas businesses to collect VAT and then pay it to the UK. Surely such businesses are not governed by UK law (sure sales into UK customers are but the companies themselves are located outside it). So how is UK Govt / HMRC going to enforce it? International court cases for VAT on cumulative sales of orders <£135. Seems unlikely

That's not really how it works. Countries signed up for common VAT rules simply charge the VAT as they would on any other domestic sale. So if you're a business in Germany, you charge VAT on your sale to everyone in the EU as they are all in the common VAT group. This used to include the UK. That German company notes on their VAT return that they collected VAT from an overseas sale and that money is paid to the local government. Behind the scenes, the countries all have agreements on how that VAT is distributed among the members of the common VAT group. It's not done on a sale-by-sale basis.

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 8:38 pm

by sean_iow

Isn't that the old system? From the 1st January it's changed, from the Government website

For goods sent from overseas and sold directly to UK consumers without OMP involvement, the overseas seller will be required to register and account for the VAT to HMRC.

Full details here

https://www.gov.uk/government/publicati ... he-changes

Re: Overseas purchases and imports

Posted: Mon Jan 04, 2021 8:44 pm

by Gari

I bought some winter boots from Rose in Early December to avoid this very possibility, so glad I did now looking at this.